social security tax limit 2021

For earnings in 2022 this base is. The rule for the year you reach full retirement age also applies when working with the monthly limit.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Married filing separately and lived apart from their spouse for all of.

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

. This amount is also commonly referred to as the taxable maximum. Ad Quickly Prepare and File Your 2020 Tax Return. If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

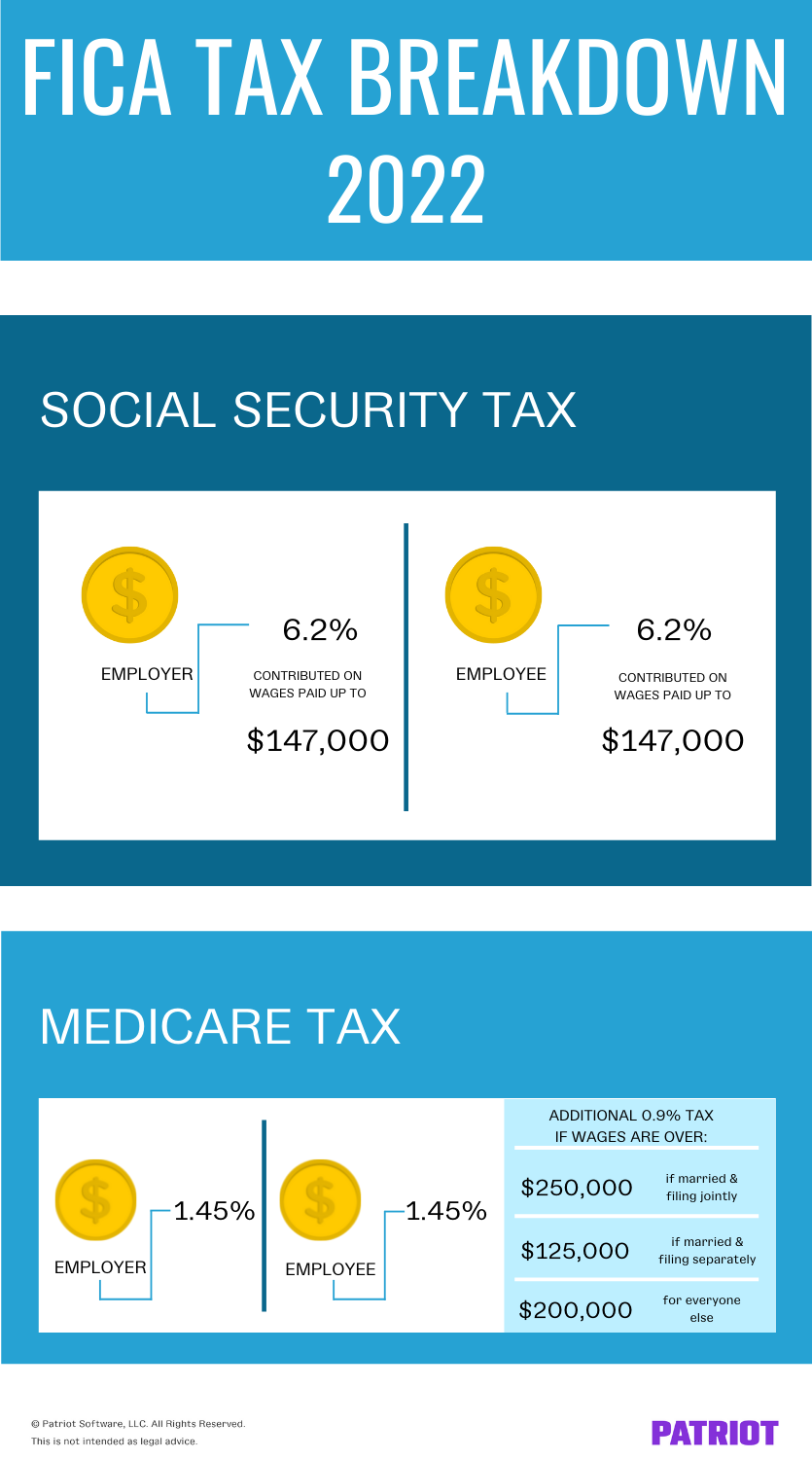

This is the largest increase in a decade and could mean a higher tax bill for some high earners. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. 9 rows This amount is known as the maximum taxable earnings and changes each year.

What is the Social Security cap for 2021. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad.

We call this annual limit the contribution and benefit base. 2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021.

In 2021 the threshold was 18960 a year. During the year you reach full retirement age the SSA will withhold 1 for every 3. That threshold will rise to 19560 a year in 2022.

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. In 2021 the Social Security taxable maximum is 142800. Listed below are the maximum taxable earnings for Social Security by year from 1937 to the present.

The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which. Our free federal filing includes life changes and advanced tax situations. The change to the taxable maximum called the contribution and benefit.

Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. When you work you earn credits toward Social Security benefits. Year Maximum Taxable Earnings 1937-1950 3000 1951-1954 3600 1955-1958.

The maximum earnings that are taxed have changed over the years as shown in the chart below. For earnings in 2022 this base is 147000. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. For married couples filing jointly you will pay taxes on up to 50.

The OASDI tax rate for. Workers pay into the Social Security system until their income reaches the Social Security tax limit for that year. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

More than 44000 up to 85 percent of your benefits may be taxable. How is Social Security taxed 2021. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

The wage base limit is the maximum wage thats subject to the tax for that year. If you earned more than the maximum in any year whether in one job or more than one we only. Essentially you are considered retired unless you make more than the income limit.

Only the social security tax has a wage base limit.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Is The Social Security Tax Limit For 2022 Gobankingrates

What Is Social Security Tax Calculations Reporting More

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Social Security Wage Base Increases To 142 800 For 2021

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

What Is Social Security Tax Calculations Reporting More

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security What Is The Wage Base For 2023 Gobankingrates